What would you as a renter consider to be an emergency? Natural disasters, certainly. Fires, floods and terrorist attacks are all probably on the list. Some of you may have even thought about what you would do during a zombie attack. But what about more personal emergencies such as illnesses and overdoses? What about maintenance emergencies in your apartment that you cannot repair on your own?

There's plenty of sites that will give you guides on what to keep in assorted kits for use in case of emergency. The Department of Homeland Security has a good one at Ready.gov but it lists items for a bare minimum kit to use in a true weather or war-related disaster. Government emergency preparedness sites focus on major disasters that would affect huge swaths of the population. It doesn't necessarily address the all of the real life needs of urban renters nor does it consider less serious personal emergencies that may still be life-threatening or at least hazardous.

Our list today will focus on the things that the government sites leave out. This is not to discount the lists that they provide - by all means keep those plastic sheets and bottles of water on hand if you want to. Rather, it provides things that renters should add to their list of emergency supplies on top of the more well-known lists.

1. Three months of rent in a separate bank account.

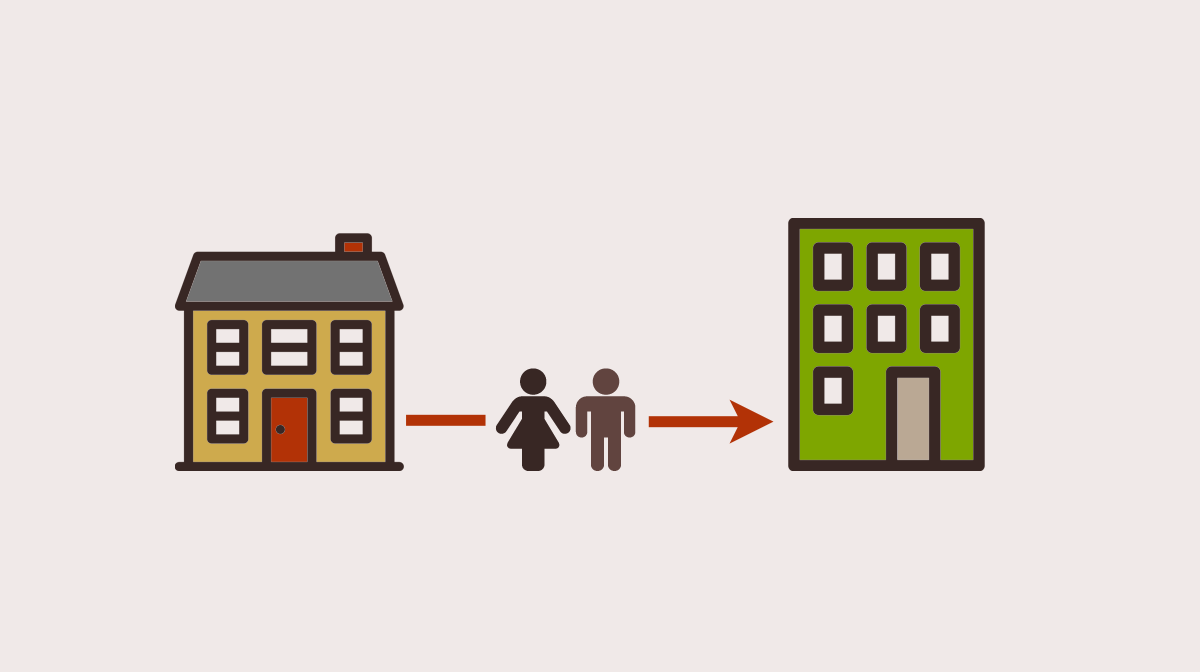

There are so many people who remain in dangerous housing because they can't afford to move. You should always be ready with three months of rent on hand - enough to cover a new security deposit, first month's rent, moving and utility setup costs. You never know when you're going to have to move in a hurry or come up with extra cash. Your roommate might get arrested. You might break up with your partner. Your landlord might sell the building to the Trump Organization. No matter the cause, always have the cash on hand to get out in a hurry. It's best to set this aside in a separate bank account and a separate bank from the one you normally use and limit your access to it. Get an ATM card only, or ideally no card at all. Continue reading Renters, Here are the Emergency Supplies That Nobody Mentions